• Requirement for Payment for TDR/ Fungible FSI

• Society Redevelopment/ SRA

- No Land available for Mortgage

- Requirement of additional Collateral (How many times Cover)

• One of the solutions is 'collateral free' loans offered by NBFC's and structured debt by PE funds based on net cash flows.

• Balance Transfer

- For developers funded by PEs at Land acquisition/ Approvals stage

• NOW Approvals are in place

• Replacement of PE - High cost debt to Lost cost debt funding

• Last-Mile Funding

• Take over of projects through JV/JDA

- Bring together ‘Seller’ & ‘Buyer’ along with ‘Funding’

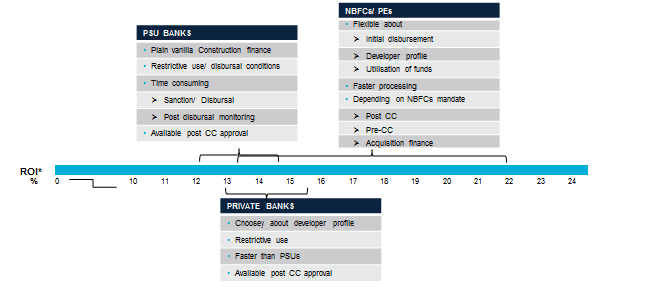

• Factors causing higher ROI for RE project bank finance;

- No industry status

- On RBI’s cautionary list

- Higher provisioning norms

• Leading to banks more money being blocked

* Subject to developer profile, project stage, purpose of funds, etc.

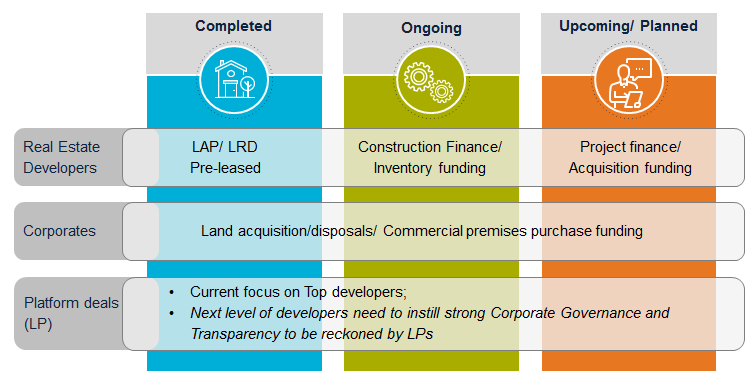

Transaction structuring

- Based on factors including

• Projects-mix (SRA/ redevelopment/ plot development)

• Project stage (acquisition/ approval/ construction)

• Purpose of funding (Balance Transfer/ Further payment of TDR/Fungible premium)

• JV/ JDA funding

Transaction Terms & conditions and Documents

- Competitive Interest Rates/Processing Fees

- Tenure/ Moratorium/ Repayment period

• JV/ JDA funding

- Pre-payment charges

- Clauses sanction letter and in final loan/DTD documents

Post Disbursement

- Disbursement of balance loan tranches

- Project monitoring

Group Related

- Project Delivery

• Construction completed (In Square feet/ No. of projects delivered)

• PE (Over Million(s) sq ft preferred)

• NBFCs (>2/5 lacs sq ft & linked to funding ticket size)

• Number/ Type of projects

• Construction timelines, delays, if any

- Sales performance

• Past projects- Sold/Unsold

- Credit Profile

• Positive Credit HISTORY preferred

Project Related

- Location

• Tier I cities – PE/ Banks/ NBFCs

• Tier II – Banks/ NBFCs

- Current project’s Sales velocity

- Stage of the project

- Fresh loan or Refinance/Take over

• Financial Closure means;

- There is or there will be enough money or cash inflows to complete the project in all respects till OC.

• Three main sources for Financial Closure;

I. Builders Equity

II. Sales advances

III. Project finance/ Construction finance

• Why Financial Closure

- Changes in Business Scenario / Government Regulation

- Tapering of Investor’s interest in real estate

- Commitment of project delivery under RERA legislation

- Impact of GST – Customer looking for ready property impacting slower sales in under construction property

• Uninterrupted construction progress with Construction finance will provide confidence to potential customers